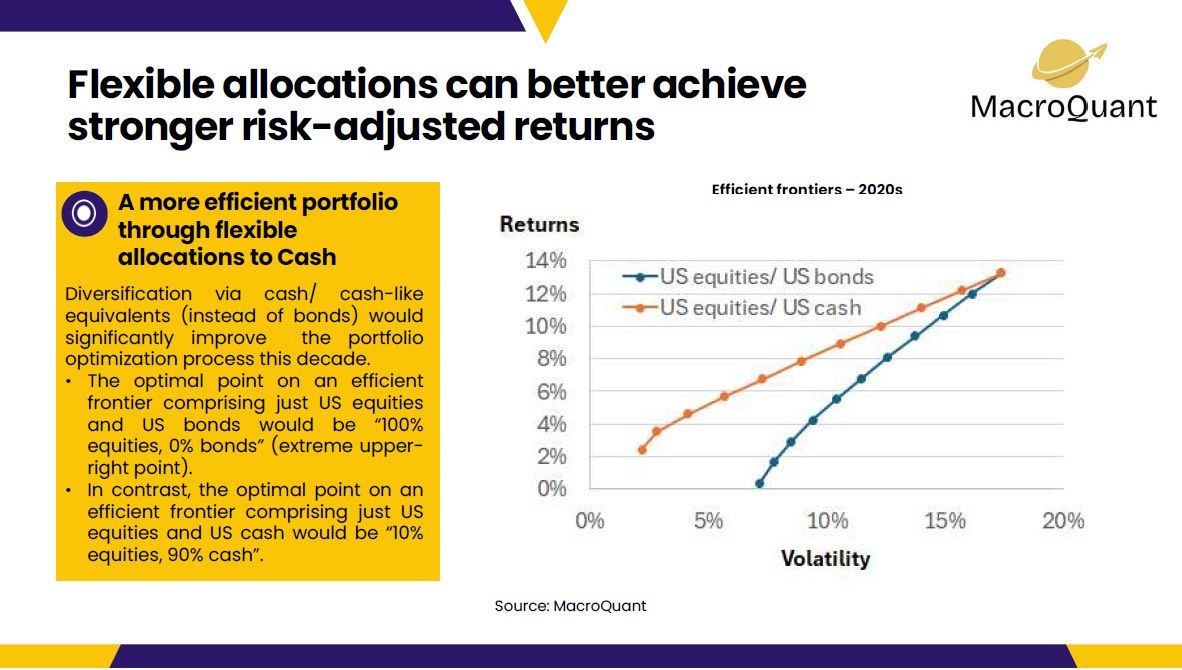

The efficient frontier for the current 2020s decade

Flexibility in switching to cash/ cash-like equivalents from sovereign bonds would have led to a significantly more efficient portfolio this decade

The efficient frontier is the foundation for Modern Portfolio Theory (MPT), which is the idea of how investors aim to create a portfolio that maximizes expected returns based on a specific level of risk. Higher expected returns is typically associated with higher volatility, thus the efficient frontier tends to be an upwards-sloping curve.

Yet the empirical data does show how a swift change in macro conditions can alter the return-risk characteristics of this efficient frontier. The current 2020s decade (i.e. 2020 to mid-2025) is a classic example of how allocations in Cash or Cash-like equivalent becomes a key component towards moving to a more optimal point of the efficient frontier. In a “higher-for-longer” interest rate environment coupled with expansionary fiscal stimulus, the terminal Fed Funds rate could potentially stay higher around current levels, thus US long-term bond yields would remain positively correlated with US equities. Hence the efficient frontier generated by a mix of US equities & US sovereign bonds from 2020 to mid-2025 appears more as a line, and not an upwards-sloping curve. In this instance, flexible allocations to Cash can help investors achieve stronger risk-adjusted returns.

Importantly, would the remaining half of the current 2020s decade (i.e. mid-2025 to 2030) continue to be an “exceptional one”/ outlier with Cash offering better diversification benefits than bonds? Or should investors default back to US bonds, and not US cash?

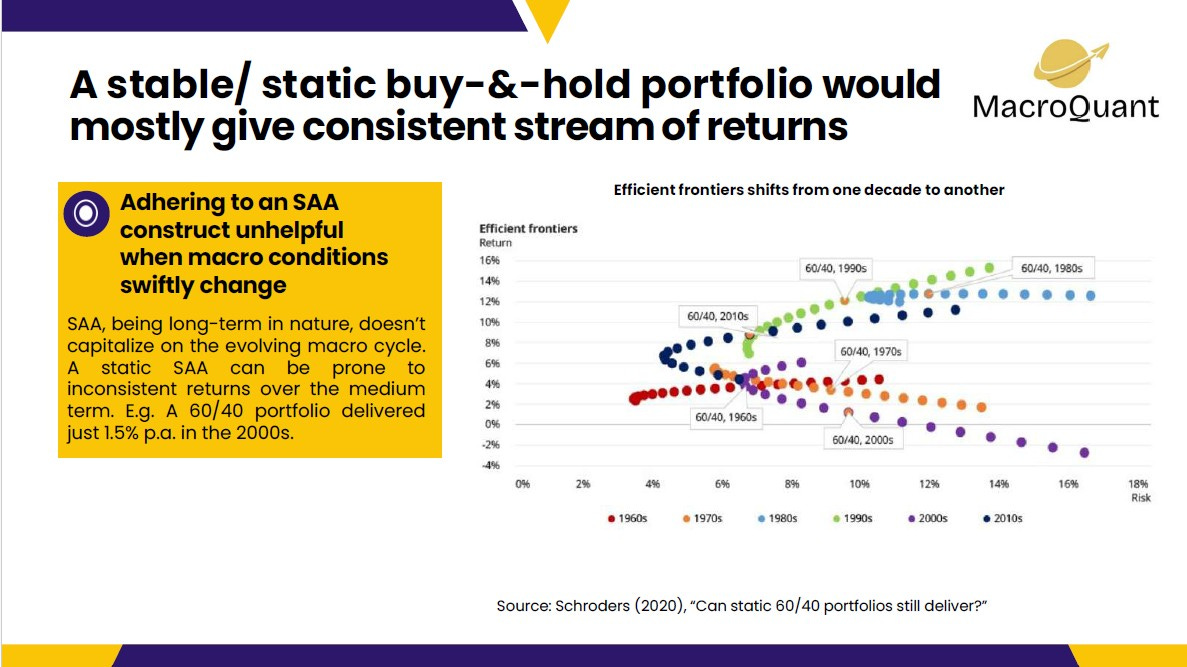

In Can static 60/40 portfolios still deliver?, Schroders studied multi-asset portfolios holding 60% US equities and 40% US sovereign bonds from one decade to another (1960s to 2010s), and two broad observations emerge:-

(a) Adhering to a stable & static portfolio would have been only been effective in 4 of the past 6 decades (1960s, 1980s, 1990s, and 2010s). Taking more risk was penalised with lower returns in the 1970s and 2000s. While an investor would likely be more circumspect in the 2000s decade (extremely high valuations which implied very low equity returns subsequently that decade), it would be considerably more difficult to navigate through the 1970s decade which was characterised by stagflation and oil crises (the 1973 Oil Crisis, triggered by an embargo from Arab nations).

(b) Returns from one decade to another can be quite different for the same level of risk. For instance in the 2000s decade, a 60/40 portfolio delivered sub-par returns of just 1.5% p.a. for taking around 10% risk.

Flexibility and nimbleness in dynamically adjusting portfolio exposures, especially between bonds and cash, may very well continue to enable investors to stay on a more optimal point of the efficient frontier, and harvest strong risk-adjusted returns!