Introducing MacroQuant's DeepBlue forecaster

Our novel approach utilizes advanced data analytics so as to systematically and objectively predict the specific phases of the evolving macrofinancial cycle

Dynamic asset allocation (DAA) has increasingly gained recognition as a tool for asset owners to generate alpha. While DAA was historically more viewed as a risk management tool, asset owners have increasingly used DAA to boost risk-adjusted performance.

In this study, we introduce an asset allocation model based on a key macrofinancial cycle driving financial markets. Industry practitioners such as Schroders, Fidelity and Invesco often emphasize the importance of the business cycle when investing. Our macrofinancial cycle can be characterised by 3 phases – upcycle, midcycle, and downcycle. “Upcycle” can be characterised as having healthy macro dynamics, “midcycle” translates to muddling-through macro dynamics, and “downcycle” translates to recessionary macro dynamics.

Accordingly, the expected returns on equities would be high during the upcycle, moderate during the midcycle, and low during the downcycle. These 3 phases were built from 1969 and constructed and classified via the levels of, and changes in, selected key variables drawn from labour market and financing dynamics. These phases of the macrofinancial cycle can be detected and summarised in the chart below, from 1969 to mid-2000.

Different from Wall Street’s macro forecasting which could be rather subjective or qualitative, our novel approach utilizes advanced data analytics so as to systematically and objectively predict the specific phases of the cycle a couple of months out (say, a 3 months look-ahead). Specifically, our Deep Blue equivalent is trained on large datasets spanning from 1969 to 2000. Post dimensionality reduction, approximately 80 features are used and this machine-learning model can then predict the subsequent ebbs and flows of the macrofinancial cycle from 2000 to 2025. This can be seen in the chart above.

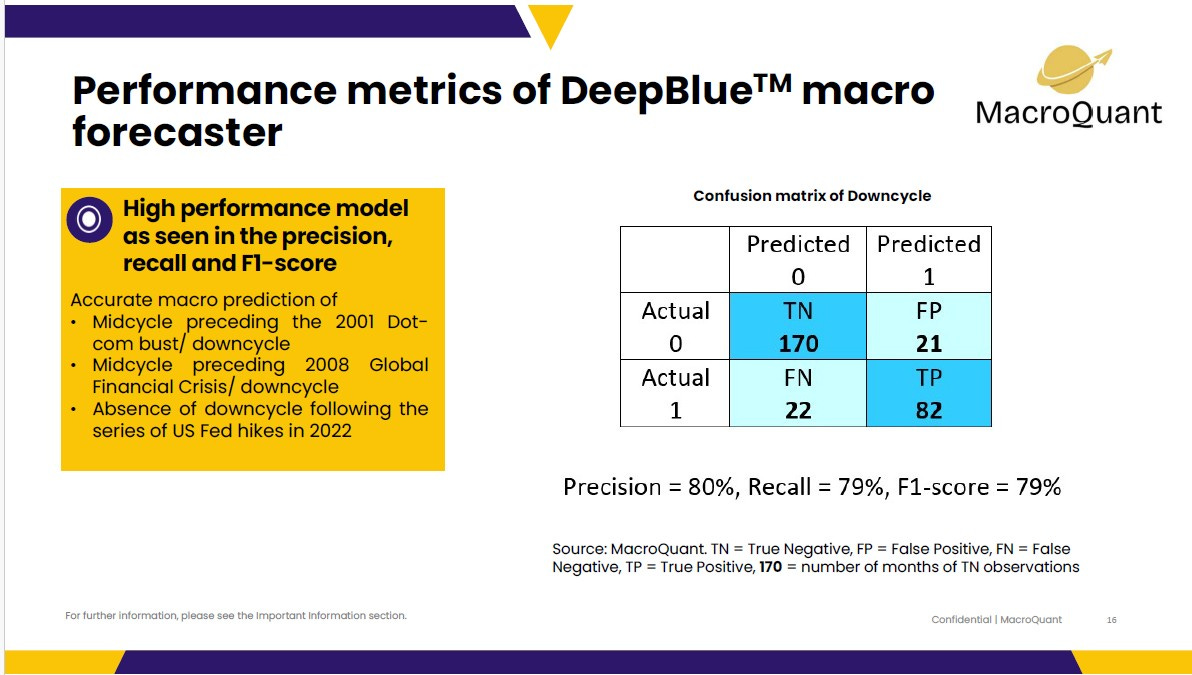

In this out-of-sample test, the machine-learning model accurately predicted the midcycle phase preceding the 2001 Dot-com bust and the ensuing downcycle, and likewise the same for the 2008 Global Financial Crisis. Another noteworthy and accurate prediction in more recent times has been the absence of a downcycle following the series of US Fed hikes in 2022. Specifically, the model forecasted (a) midcycle dynamics whereas Wall Street expected a recession in 2023; (b) an upcycle starting in 1Q 2024 even as Wall Street expected a recession in 1H 2024; (c) an upcycle in 3Q 2024 even as the SAHM rule triggered fears that a recession has started.

Overall, when the prediction output was reviewed against the actual phases on a monthly basis from 2000 to 2025, the confusion matrix shows that this machine-learning model has high efficacy, with Precision, Recall and F-1 scores ranging between 79% to 80%.

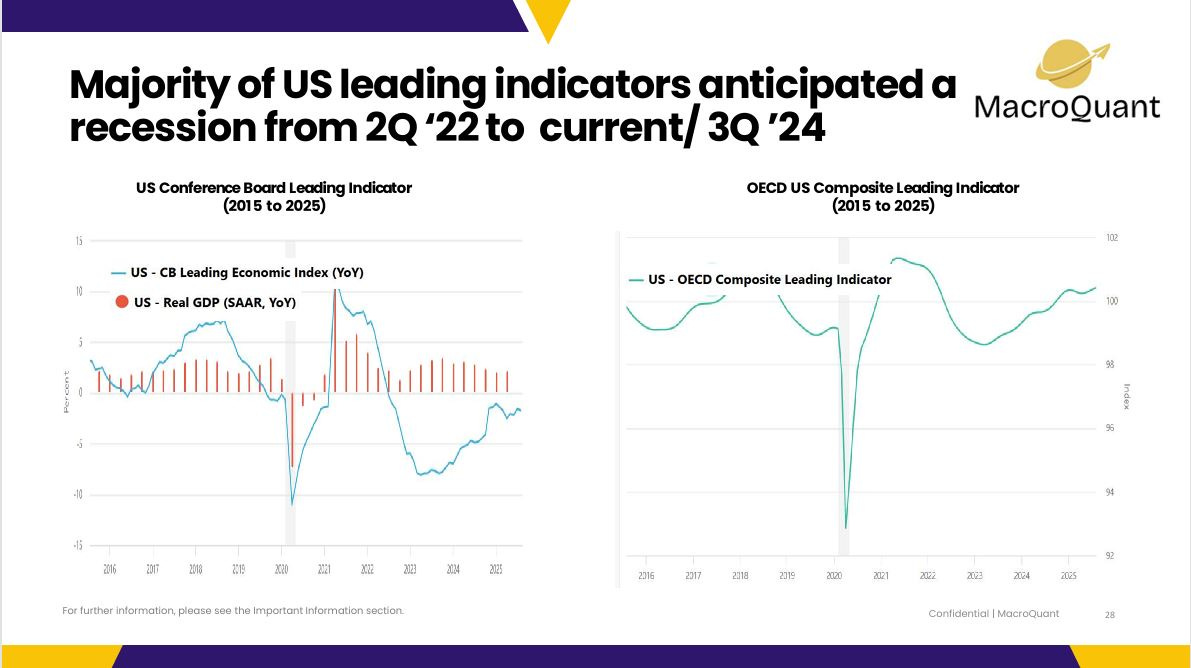

DeepBlue’s predicted output is clearly unique and different from the Wall Street consensus, the latter overlaps quite closely with the view from US leading indicators such as the US Conference Board and the OECD.

The key strengths of a Deep Blue equivalent over traditional macro-forecasting are:

· Methodical and logical processing of data, through removing human emotions and biases.

· Ability to process large data and complex interactions.

· Ability to pick up non-linear interactions.

Finally, these monthly signals can be used for aggressive and defensive tilts, and one can implement small aggressive tilts of up to +10% ( (i.e. re-allocating 10% from risky-free assets to 10% risky assets) in anticipation of Upcycle (e.g. a Goldilocks regime), and defensive tilts of -10% in anticipation of Downcycle. Such small aggressive tilts can boost annualised returns by between 1% to 1.5% per annum.